When you are investing or doing business with any company you want to be sure that company is healthy and trustworthy. The last thing you need is to send money to a precious metals or gold dealer that is in financial trouble and might not be able to deliver your purchase or even later refund your money. Gold dealers, like any company, can run into operating problems. This can happen and did happen with a major precious metals dealer called the Tulving Company. That company failed in early 2014, declaring bankruptcy in March of 2014. That failure, by some estimates, left upwards of a thousand customers owed over $40 million dollars. The Tulving Company was a large well respected company that had operated for over 20 years in the precious metals marketplace. They had many loyal customers. But when a company like that fails it can be very financially painful to customers doing business with them. This is a good example of the importance of doing your due diligence and making sure the company you are working with is healthy and reputable.

Here are three good reasons to be sure you know your dealer:

1. A dealer who is in financial distress might not be able to deliver your products, or even refund your money. This apparently happened to customers of the Tulving Company.

2. A dealer who is not reputable and trustworthy could give you prices that are too high or suggest purchases or sales that are not in your best interests. They will make money, you will not.

3. A dealer who is not working to deliver great value to customers often will be partnered with other companies such as storage vault providers that do not provide the type of storage you really need or they overcharge for those services.

You can imagine all the bad things that can happen when you deal with a company that does not have the interests of its customers as their first priority. Those sort of companies can become very unpleasant to work with when it comes time to sell or make some other adjustment to your account. All of these concerns should make it very clear to you that it is important to select a trustworthy, reputable and healthy company when you do business.

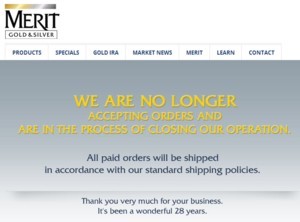

Another well-known precious metals company, Merit Gold, announced they are going out of business in the fall of 2014. Looking at their complaint history at the Better Business Bureau prior to their closing you see the increase in complaints of all sorts. That is a key warning sign of a company in distress. The complaint types included: Advertising / Sales Issues – 2 complaints, Delivery Issues- 6 complaints, Problems with Product / Service – 6 complaints. You should avoid companies that are having many of these problems. Before doing business with a company take a look at their history at the Better Business Bureau, the Business Consumer Alliance and the other review sources listed on this site.

Another well-known precious metals company, Merit Gold, announced they are going out of business in the fall of 2014. Looking at their complaint history at the Better Business Bureau prior to their closing you see the increase in complaints of all sorts. That is a key warning sign of a company in distress. The complaint types included: Advertising / Sales Issues – 2 complaints, Delivery Issues- 6 complaints, Problems with Product / Service – 6 complaints. You should avoid companies that are having many of these problems. Before doing business with a company take a look at their history at the Better Business Bureau, the Business Consumer Alliance and the other review sources listed on this site.

It is no secret, but one of the easiest ways to evaluate companies, especially precious metals or gold dealers, is to review their performance and history with independent review sources. We look at multiple sources of information for each company we review on this site: 1. Business Consumer Alliance, 2. Trustlink, 3. Yelp, and 4. The Ripoff Report. Each of these companies provides information or review services that together can very much help you understand who are the stronger and better companies to do business with. We summarize all of that information on this site for you to speed your review of these companies.

.

Your IRA or 401(k) plan are at risk. Read this Free Report: The #1 reason why if you’re saving for retirement, you could be looking at a perfect storm of losing your savings.

Your IRA or 401(k) plan are at risk. Read this Free Report: The #1 reason why if you’re saving for retirement, you could be looking at a perfect storm of losing your savings.

.

.

.

Making the right choice is critical to ensuring your money is safe and investments are being made to your best advantage. Using these five independent review sources for each dealer of interest can give you an indication of trouble brewing if you notice an increase in customer complaints or delayed shipping or payment problems. That sort of information helps you know who is perhaps getting into trouble or performing poorly before you do business with them. You have enough to worry about in life and don’t need to find yourself dealing with a precious metals dealer who is going bad or delivering poor value to customers.

Read this article about the collapse of the Tulving Company. You can see from that article that even companies that were once strong with many loyal customers can get into trouble and fail. Before you invest with any gold dealer, you need to take a little time to be sure the company you choose is a healthy, top-tier performer.

Choosing the Best Precious Metals Dealer for Your Gold IRA: A Guide to Secure Investments

Selecting the right precious metals dealer is a crucial step in ensuring the success and security of your Gold Individual Retirement Account (IRA). In this comprehensive guide, we will walk you through the essential factors to consider when choosing a precious metals dealer, underscore the significance of reputation, pricing, and reliability, and provide clear guidance on how to verify the authenticity of precious metals purchased for your IRA.

Factors to Consider When Selecting a Precious Metals Dealer:

- Reputation and Experience: Look for dealers with a long-standing and reputable presence in the industry. Established dealers often have a track record of trustworthiness.

- Licensing and Compliance: Verify that the dealer is licensed and complies with all relevant regulations and standards.

- Selection of Precious Metals: Ensure the dealer offers a diverse range of IRS-approved precious metals, including gold, silver, platinum, and palladium.

- Customer Service: Assess the quality of customer service, as a responsive and knowledgeable team can be invaluable.

- Transparent Pricing: Look for a dealer with transparent pricing, free from hidden fees or inflated premiums.

The Importance of Reputation, Pricing, and Reliability:

- Reputation: A dealer’s reputation is a reflection of its integrity and reliability. Read reviews, seek recommendations, and consider the dealer’s history.

- Pricing: Competitive and transparent pricing is crucial. Compare prices with other dealers to ensure you’re getting fair value for your investments.

- Reliability: A reliable dealer ensures that your precious metals are delivered securely and on time. Delays or mishandling can lead to unnecessary stress and potential complications.

How to Verify the Authenticity of Precious Metals Purchased for Your IRA:

- Ask for Certifications: Request certificates of authenticity for the precious metals you purchase. Reputable dealers provide documentation confirming the authenticity and purity of the metals.

- Third-Party Verification: Some dealers offer third-party verification services, where an independent assayer confirms the authenticity of your metals.

- Independent Appraisal: Consider getting an independent appraisal of your precious metals to confirm their authenticity and value.

- Reputation of the Dealer: Purchasing from a reputable dealer with a history of selling authentic precious metals is one of the most reliable methods of ensuring authenticity.

It is very important to your wealth and future comfort that you well understand that choosing the best precious metals dealer for your Gold IRA is a critical decision that impacts the safety and success of your retirement investments. By carefully evaluating factors such as reputation, pricing, and reliability, and by taking steps to verify the authenticity of the precious metals you purchase, you can confidently secure your financial future with precious metals in your IRA.

#PreciousMetalsDealer

#GoldIRAInvesting

#SecureRetirement

#AuthenticityVerification

Take a look at the IRA plan linked to on this page. Get that silver too! That can help you have a safe and comfortable future.

.

Setting Up a Gold IRA: A Step-by-Step Guide to a Secure Retirement

Planning for a secure retirement is a significant financial goal, and a Gold Individual Retirement Account (IRA) can be an essential component of your strategy. In this detailed guide, we will provide you with a comprehensive, step-by-step walkthrough of the process of opening a Gold IRA. We’ll cover the necessary documentation and paperwork, and we’ll explain how to fund your Gold IRA and select the right investments to achieve your retirement objectives.

A Detailed Walkthrough of the Process of Opening a Gold IRA:

- Choose a Gold IRA Custodian: Your first step is to select a reputable Gold IRA custodian. Research and compare custodians to find one that aligns with your financial goals and provides the services you require.

- Complete the Application: Once you’ve chosen a custodian, you’ll need to complete the necessary application paperwork to establish your Gold IRA account.

- Select the Precious Metals: Work closely with your custodian to choose the precious metals you want to include in your Gold IRA. These metals must meet IRS-approved standards.

Required Documentation and Paperwork:

- Identification Documents: You’ll need to provide copies of your government-issued ID, such as a driver’s license or passport, to verify your identity.

- Account Application: Fill out the Gold IRA application provided by your chosen custodian. This document officially establishes your Gold IRA.

- Transfer or Rollover Forms: If you’re transferring or rolling over funds from an existing retirement account, you’ll need to complete the appropriate forms provided by your custodian.

How to Fund Your Gold IRA and Select Investments:

- Funding Your Gold IRA: There are several methods to fund your Gold IRA, including rollovers, transfers, or contributions. Work with your custodian to execute the chosen method.

- Selecting Investments: Collaborate with your custodian to determine the right mix of precious metals for your retirement portfolio. Consider your financial goals, risk tolerance, and the diversity of your investments.

- Storage and Security: Discuss storage options with your custodian. You can choose between third-party storage or secure home storage, each with its advantages and considerations.

- Monitor and Adjust: Once your Gold IRA is established, regularly monitor its performance and adjust your investments as needed to stay aligned with your retirement goals.

For your future comfort and security you need to understand why setting up a Gold IRA is a strategic step toward that desired secure retirement. By following this step-by-step guide, completing the necessary documentation, and collaborating closely with your chosen custodian, you can confidently navigate the process and build a retirement portfolio that offers stability and growth.

#GoldIRASetup

#RetirementPlanning

#SecureFinancialFuture

#GoldInvestments