Investing in precious metals is much easier given the growth in the number of companies that sell gold and silver to the investing public. Many companies have developed online sites to make the investing process easy and convenient for every investor. We review the leading precious metal companies on this site for your convenience. To read those gold company reviews, click here.

While most people have purchased gold or silver as jewelry, gold and silver comes in many forms for investment purposes such as bullion coins and bullion bars. The use of the word “bullion” means the bar or coin is made from a precious metal such as gold, silver, platinum or palladium and is valued based on the precious metal it is made from.

The price of gold per troy ounce has recently averaged around 60x the price of a troy ounce of silver. Due to the high value of gold, a small investment weight can involve a large amount of money. A large value is stored in a small amount of gold. Finding secure storage is a must.

Many companies that work in the precious metals industry require customers to have at least $5,000.00 dollars or more to open a self-directed Gold IRA or another investment account. Other dealers listed on this site will fulfill orders for coins or bars at less than a $5,000 minimum purchase. SD Bullion is a good place to make purchases that total under $5,000 US Dollars.

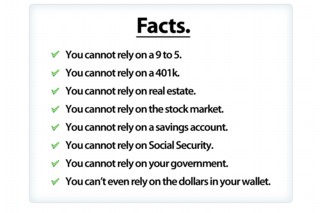

Many changes occurred in the financial markets during the years since the financial panic of 2008. Those changes have important implications for every investor. Banks are bigger now than then, debt levels are much higher, and the size of the exposure to derivative contracts has grown. Unfortunately, this means that the level of risk in the financial system is larger now than in 2007. The financial market turmoil that began in 2008 and the ongoing global conflicts that have evolved since highlight the importance of gold as an element of any investment portfolio designed to weather the stormy years ahead.

Gold and other precious metals have risen in importance as an asset class to hedge the risks of another financial downturn. There have been many significant changes over the past few years in the financial markets such as the greater debt levels of banks and sovereigns and the larger exposure of banks to derivative contracts. Many experienced market observers fear the current conditions in the global financial markets heighten the risk of another major downturn. Big changes are in the wind and many informed investors have moved quietly and firmly to position themselves with physical holdings in precious metals such as gold and silver.

Buying Gold and Silver

Acquiring physically held gold and silver is an activity that many smart investors have undertaken to protect their wealth from the adverse effects of high inflation, currency debasement or a global financial crisis. These adverse events, as each might unfold, could strongly and negatively affect the value of stocks and bonds denominated in US dollars or another currency. An investment in physically held gold or other precious metals is seen by many as wealth insurance.

The precious metals dealers listed on this site can help you make the right investment in precious metals for your unique needs. Each company has strengths and weaknesses. In a clear and understandable manner the reviews on this site present each gold dealer to make it easier for you to choose the right company for your needs. Choosing a trustworthy precious metals company is very important for making the right investment decisions when its comes to buying gold or silver that you physically own. You need to make sure you get fair and full value for your money. You do that by selecting and working with a trustworthy and reputable precious metals company. This is important for setting -up a Gold IRA or for taking personal delivery of gold or silver.

Precious Metal Production

South Africa, Russia, China, Australia, Peru and America are important producers of gold. Each country has significant precious metals mining operations. China and Russia have each kept all their mined gold over the past few years as they have focused on building-up their gold stockpiles to position themselves favorably in the global financial markets to come.

In general, anytime gold production goes up due to more mining activities, the quantity of gold available for purchase by individual investors increases. That is the usual effect, but in the case of gold in recent years the demand from some countries such as China and Russia, along with the increased holdings by central banks, has tightened supply even as production globally has gone up. In many places where gold reserves do exist the mines need to go deeper to unearth the precious metal. Because of these and related issues, there have not been any large increases in gold supply over the past decade. Here are the numbers for worldwide gold production for your review. If you would like to read even more, get this Guide to Precious Metals.

Did you know that gold is so rare that all the gold ever mined would create a block of gold about one third the height of the Washington Monument in Washington, DC. Think about that. That’s all the gold in the world. Gold is rare and difficult to mine and refine. It has acted as a money for mankind for thousands of years. It cannot be created by governments out of thin air and the supply of gold is getting smaller and smaller relative to the amount of currency being printed each day in the US, Europe, and Japan. What does that situation mean for the price of gold over the long-term? Many investors recognize the unique situation we are in and have opted to purchase physical gold to hold in their retirement accounts or other financial accounts for the long-term. This is to protect wealth that can otherwise be eroded away quickly by high inflation or a currency crisis.

Gold Buyer Interest vs. Gold Supply

The cost to mine and produce more gold rises with the increased difficulty of extracting the gold from sites and with inflation. The price of gold is set by trading in markets affected by supply and demand. Because there is a large hoarded supply of gold that far exceeds the annual mined quantity of gold, the price of gold is more affected by the willingness of large holders and other sellers to sell than it is by the constraints of mining. Gold is also traded in the futures market, which is a paper market that is about 100 times larger than the supply of actual physical gold. That paper market has a huge influence on the price of gold. Many governments have used that paper gold market to manage the price of gold in recent years, attempting to hold the price down to mute the alarm signal that a steadily rising price of gold would be. As the physical supply of available gold dwindles, the ability to suppress the price becomes harder and harder for central banks to do. There will come a point where the central banks can no longer slow the rise in the price of gold.

While well-to-do investors around the world utilize gold and other precious metals for wealth preservation, gold and silver also have numerous fashion and industrial applications. Over 50% of the worldwide gold demand is for gold jewelry. About 12% of available gold is used in industry for electronics, dentistry or for aerospace needs. Because of its excellent corrosion resistance, gold is highly prized for building computer systems, cellphones and television sets. Gold and silver are utilized in the pharmaceutical industry for antibiotics and for creating devices like stents in the medical industry, among many other uses.

The Dollar

Gold prices generally would be expected to move in an opposite direction to the direction of dollar strengthening or weakening, meaning that when the dollar strengthens gold prices would tend to decline, and when the US dollar weakens gold prices would climb. This would certainly be the case in a free market not subject to periodic manipulation by governments and central banks.

Over the past few years, governments and central banks have aggressively intervened in the gold market in particular to manage the price. Because the price of gold is looked to as an indicator of the health of the financial system there has been activity from governments and central banks to mute that warning signal by entering the gold futures markets to manipulate the gold price. The central banks want to mute the alarm signal that a steadily rising gold price would be as they attempt to restore public confidence in currencies. The Federal Reserve, for example, acts to protect the dollar as a leading reserve currency. They try to reduce the importance of gold to support the importance of the US Dollar in global trade. Sophisticated investors are well aware of this and have taken that price suppression and market intervention as a signal to invest in gold and other precious metals while the price is being held down.

Gold and silver have long been used in the financial affairs of man. Gold and Silver are money. Money is a store of value and medium of exchange. In the global financial  markets of today, holding gold and silver is often done as an insurance policy to protect against catastrophic currency events or global financial crisis. Those events are certainly a concern today as the US and many large countries continue to struggle with significant financial imbalances that first manifested themselves in the 2008 financial panic. Many of the underlying causes of that financial panic are still with us today. Some elements of that panic have only become more severe: greater debt levels and larger exposures to derivatives. Many investors recognize the imbalances and also recognize that the US dollar is being managed through a long-term decline. Those investors hold physical gold and silver as insurance against an increasingly unstable US dollar. Dollar volatility in the global markets has been a precursor to tumult in the past, as noted by this article “Guess What Happened The Last Time The U.S. Dollar Skyrocketed In Value Like This?…“

markets of today, holding gold and silver is often done as an insurance policy to protect against catastrophic currency events or global financial crisis. Those events are certainly a concern today as the US and many large countries continue to struggle with significant financial imbalances that first manifested themselves in the 2008 financial panic. Many of the underlying causes of that financial panic are still with us today. Some elements of that panic have only become more severe: greater debt levels and larger exposures to derivatives. Many investors recognize the imbalances and also recognize that the US dollar is being managed through a long-term decline. Those investors hold physical gold and silver as insurance against an increasingly unstable US dollar. Dollar volatility in the global markets has been a precursor to tumult in the past, as noted by this article “Guess What Happened The Last Time The U.S. Dollar Skyrocketed In Value Like This?…“

Bank Deposits

Global financial conditions and the central banks view of the US Dollar affect decisions related to gold sales or purchases by the central banks. The central banks work together in the gold markets as this announcement from Europe indicates. Over the past few years, many central banks have been buying large amounts of gold to add to their reserves. Why? Because the global financial markets are facing difficult times ahead as countries try to manage the huge debt loads that have accumulated around the world. When the central banks become buyers of gold most investors recognize that as an important signal telling them that tough times are ahead. Many individual investors see that the Chinese are buying gold and halting purchases of US debt. They understand what this indicates and they too purchase gold and silver to hold in their personal retirement and investment accounts.

Too many countries have excessive debt loads and have been printing their currency with abandon in an effort to support exports. That is bringing into question the ability to sustain long-term confidence in, and the value of, currencies such as the US Dollar, the Euro, or the Yen. Gold holdings matter when conditions such as these develop. We are in a time where gold matters to central banks and nations. Many investors understand that means Gold and Silver are important holdings to protect their retirement funds or wealth over the long-term.

Gold and Precious Metal Pricing

As with any other investment choice, every investor in gold, silver or other precious metal needs to stay informed about the trends and conditions that affect the financial markets. You want to protect your wealth. Everyone who owns physical gold or silver in a retirement account or another investment account needs to understand the price trends and the drivers of those prices. This site provides information about the latest gold and silver prices and when to sell. Many companies, such as those we review on this site, also provide Investment Guides to help the investor understand how to place gold or other precious metals into a retirement account or another investment account.

When buying gold an investor needs to first do an appropriate level of due diligence. Although there are many reputable dealers in the market there are also swindlers who act to rip-off investors through overpriced products or services. The bad apples can be avoided by selecting and working with trustworthy and reputable companies that are highly rated by customers and third parties such as the Better Business Bureau, the Business Consumer Alliance and Trustlink. Look for reliable and well established gold companies such as Regal Assets. Quality companies ensure investors receive fair value for their money and make the right investments for their needs. Before making any investment decision, talk with at least a few gold and silver dealers to ensure you have the information and perspective to make the appropriate decisions about how much to invest and how to make the investment.

How To Purchase Gold

With the right information, you can successfully invest in precious metals such as gold and silver with confidence. The good news is that in today’s markets, as opposed to even the recent past, individuals do not need to visit a gold dealer to get their hands on some real gold. With reputable and trustworthy gold companies online it is possible to browse through the gold and silver products presented on the gold dealers websites, review the prices and buy what best meets your investment needs. Selecting a reputable and trustworthy gold dealer is one of the most important choices you will make. Take the time to ensure you find and work with a precious metals dealer who will treat you right. Look at the experiences of other customers as a key indicator of dealer quality. Great dealers have satisfied customers. Bad dealers have many unsatisfied customers. Choose your dealer wisely.

If you only want to hold exposure to the price movements of gold or silver you don’t need to literally own physical gold to benefit from the price movements. In that case, you can always purchase gold exchange traded funds ( ETFs ), gold company stock or gold options, or even buy gold mutual funds. Those sort of investments are fine when the markets are functioning, but those paper investments are not going to protect your wealth if there is a currency crisis, market collapse or related economic crisis. That’s when you benefit from owning and holding physical gold or silver.

Owning physical gold is how investors protect wealth through tumultuous financial market events. When you opt to take direct title to physical gold or another precious metal, arranging for protected storage is important because gold is very valuable for its weight. You need to store gold and other precious metals in a secure place.

Jewelry is normally not the most effective gold investment. Most gold jewelry is 22 carat, which is a purity of 91.67% gold. 24 carat is 99.9% pure gold. The 22 carat jewelry is alloyed with other metals to increase its hardness so that it wears longer, but that means its gold content is lower. For reference, 18-Carat gold is 18 parts gold 6 parts another metal, thereby forming an alloy that is 75% gold. For investment purposes, buying gold or silver bullion is typically the preferred way to own gold rather than jewelry.

Regardless of what form of gold you choose to purchase, you have to think of gold as an investment for the long-term. Don’t expect to make fast profits from gold. Gold is a long-term store of wealth.

Before investing in precious metals you need to choose a company with a good reputation, finding a dealer who is reputable and trustworthy. Items such as customer testimonials and quality ratings from the Better Business Bureau, the Business Consumer Alliance and Trustlink should be taken into account when selecting a gold supplier. Look over the gold company reviews on this site to help you make the right choice for your unique investment needs.

To learn how to invest in gold or other precious metals get your free copy of the Investment Guide. You can make better choices when you understand the basics.

.