Company Name: Kitco Gold

Website: http://www.kitco.com

Founded: 1977

Owners: Mr. Bart Kitner (Owner)

Location: Rouses Point, NY 12979

Business Consumer Alliance: No Record: Click Here to See the BCA Site.

Trustlink: No Record: Click Here to Visit the Trustlink Site.

Yelp: See the reviews: Click Here to See Yelp Report.

The Ripoff Report: No Reports filed: See the Ripoff Report site

.

Kitco video

.

OUR RECOMMENDATION

Goldco

Read the reviews of the other precious metals dealers. The reviews are here.

Editor’s note: Let us know if you see something on this page that needs to be updated. We strive to keep all the information current.

Gold IRA Investment

.

What Is a Gold IRA Investment?

A gold IRA is an Individual Retirement Account in the US in which gold and other IRA-approved precious metals are held. This is in contrast to a regular IRA in which paper-based assets or paper currency are held in the account. A gold IRA works like a regular IRA, the only difference is that this plan holds physical gold such as bars or coins. Usually, these precious metals IRAs are self-directed IRAs that allow holding diverse investments in the account while giving the account holder control over those investment choices. Though a gold IRA is typically a self-directed IRA there are other types of retirement accounts that can convert into gold IRAs, such as 401k, Thrift Savings Plan (TSP), and Roth IRAs.

What Are the IRA-Accepted Precious Metals?

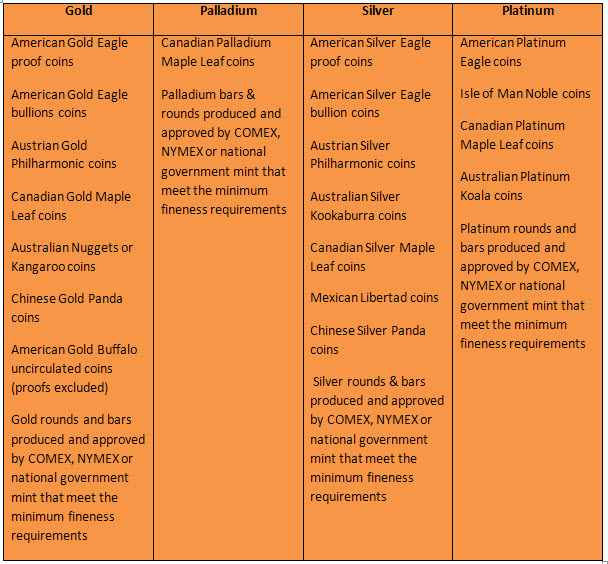

Selected forms of bullion and precious metals are approved by the IRS to be held in IRAs. Gold bullion coins are a smarter investment option as opposed to gold bullion bars which are more expensive to sell, heavier to deliver physically, are easier to imitate, and require a greater amount of security.

IRA-approved precious metals include:

What Are the Different Types of Gold IRA Investments?

• Gold bullion

• Gold mining rights

• Gold as a hybrid of the above two types

All these investment types involve investing in gold at a set value in anticipation the price will increase over time or that the gold will act as a store of value preventing loss of wealth.

Why Invest in Gold

The most compelling reasons that gold in an IRA is better than paper-based assets:

1. Paper investments such as currencies, stocks and bonds can rapidly lose their value due to inflation, while gold, silver and other precious metals have intrinsic value.

2. Gold is always in demand and considered to be the most recognized precious metal as money all over the world.

3. Gold is a tangible asset as opposed to paper-based currencies, stocks and bonds where the value depends on something related to the paper instrument.

Why Invest in Gold Now

Red-hot deals on gold and other precious metals existed 10 years ago. But it’s not yet too late to buy if you understand the true value of gold.

In fact, gold and other IRA-approved precious metals can act as an insurance-like holding to protect your wealth in the event of a currency crisis or financial market downturn.

How to Start Investing in a Gold IRA?

Start talking with professional experts now to get the details on the ins and outs of investing in a gold IRA.

Make it a point to select and choose experts that have the ability to give you the products you want and need, a reputation of excellence and an established track record of positive customer experiences.

Receiving Distributions

The rule for taking and receiving distributions from a gold IRA is governed by the same laws that regulate a regular IRA. Holders of a gold IRA may liquidate their coins and metals for cash or take physical control over them. Both options are the same as receiving an IRA distribution and taxes will be imposed accordingly.